By Ryan Caldwell | Lead Writer, Timepieces | YouImpressed.com

Timepieces That Outperform the Stock Market Are More Than Just Wrist Candy

Timepieces That Outperform the Stock Market aren’t just worn — they’re watched. Literally, while Wall Street does its rollercoaster thing, certain luxury watches are ticking upward in a whole different economy. We’re talking six-figure flips, auction madness, and resale returns that would make a hedge fund manager sweat through his Brioni.

The watch world has been buzzing for years, but now, it’s official: Timepieces That Outperform the Stock Market are no longer unicorns. They’re part of the new asset class. From Rolex steel sports models to rare Patek Philippes, high-end horology is making a profound impact in the investment world.

Why Timepieces That Outperform the Stock Market Are Gaining Momentum

Timepieces That Outperform the Stock Market combine beauty, scarcity, and demand. While crypto and stocks fluctuate like a heart monitor, watches — at least the right ones — show steady growth. That kind of resilience is why collectors, investors, and even art dealers are shifting some portfolio weight to the wrist.

Three reasons explain the rise of these watches as assets:

- Rarity: Limited production and discontinued models drive long-term appreciation.

- Brand Prestige: Names like Rolex, Patek Philippe, and Audemars Piguet carry serious clout in both watch and investment circles.

- Tangible Luxury: Unlike stocks or NFTs, Timepieces That Outperform the Stock Market can actually be worn, flexed, and admired while gaining value.

Top Timepieces That Outperform the Stock Market

1. Rolex Daytona (Paul Newman References)

Timepieces That Outperform the Stock Market often trace back to one watch: the Rolex Daytona, also known as the “Paul Newman.” What was once a niche interest has become a full-fledged investment sensation. Auction records show that some vintage Daytonas have climbed from $20,000 to over $500,000 in under a decade.

When Paul Newman’s personal Daytona sold for $17.8 million, it sealed the Daytona’s status as king of appreciating assets. View Rolex models at rolex.com.

2. Patek Philippe Nautilus Ref. 5711

No list of Timepieces That Outperform the Stock Market is complete without the Patek 5711. Introduced in steel, killed off, then resurrected for a short Tiffany-blue encore, this watch became a cultural and financial juggernaut.

Retail: around $30,000. Secondary market? Try $120,000 to $250,000 — sometimes more. It’s a watch that broke the rules and built wealth in the process. Explore Patek’s collection at patek.com.

3. Audemars Piguet Royal Oak Jumbo

The Royal Oak Jumbo has long been a grail piece. Limited runs, distinct design, and Gérald Genta’s legacy have kept demand higher than the sapphire-topped ceiling at Watches & Wonders. One recent platinum green-dial release increased in secondary value by 300% within months.

Timepieces That Outperform the Stock Market don’t just look good — they act like gold bars with personality. More at audemarspiguet.com.

4. F.P. Journe Chronomètre Bleu

Indie watchmakers are the new Wall Street whisper. F.P. Journe’s Chronomètre Bleu retails around $30K. Try finding one for less than $100K now. Supply is low. Demand is sky high. Timepieces That Outperform the Stock Market don’t need diamond bezels — just dial chemistry and cult followings.

Journe’s pieces continue to gain popularity as new collectors discover their magic. Learn more at fpjourne.com.

5. Richard Mille RM 011 & RM 65

Richard Mille may be controversial, but the brand prints ROI like it prints carbon cases. Some models double or triple in value immediately after leaving the boutique. Celebrities, athletes, and billionaires keep demand white hot. RM 65-01? Impossible to get. RM 011? Always climbing.

Timepieces That Outperform the Stock Market often wear prominent personalities — and Mille’s the life of that luxury party. Visit richardmille.com.

How to Identify Future Timepieces That Outperform the Stock Market

Spotting the next big thing requires a mix of instinct and research. The following traits are often shared by future Timepieces That Outperform the Stock Market:

- Low Production Numbers: Scarcity drives demand and long-term growth.

- Brand Trajectory: Brands gaining buzz often deliver strong value growth.

- Design Legacy: Watches linked to iconic designers or historical moments hold value longer.

- Secondary Market Buzz: When resale starts to outpace retail, something big is brewing.

Timing matters. Sometimes a watch gains traction after it has been discontinued, or when it receives a celebrity spotlight. Being early never hurts.

Risks of Investing in Timepieces That Outperform the Stock Market

No investment is bulletproof — not even luxury wristwear. Timepieces That Outperform the Stock Market still require care, authentication, and market insight. Risks include:

- Counterfeits and frankenwatches are flooding the resale market.

- Market corrections after hype peaks.

- Overpaying for unreliable sellers.

- Damage or poor servicing that kills value.

Due diligence matters. Trusted platforms like Chrono24, WatchBox, and auction houses such as Phillips provide safer routes into serious horological investing.

Timepieces That Outperform the Stock Market Offer Emotional ROI Too

While numbers get headlines, Timepieces That Outperform the Stock Market also bring emotional dividends. Watches celebrate milestones, honor personal style, and connect generations. Try that with a mutual fund.

Wearing an appreciating asset creates a bond — and not the 10-year Treasury kind. It’s heritage, art, and mechanics all wrapped around the wrist. And sometimes, that’s the best part of the investment.

Where to Track and Learn About Timepieces That Outperform the Stock Market

Collectors, flippers, and enthusiasts alike can find more on Timepieces That Outperform the Stock Market at YouImpressed.com. Stay updated on high-performing models, investment trends, and hidden gems that could be tomorrow’s breakout stars.

Final Thoughts on Timepieces That Outperform the Stock Market

Timepieces That Outperform the Stock Market prove that luxury and smart money can live in the same place. They’re bold, beautiful, and often borderline bulletproof. From classic steel icons to futuristic carbon beasts, the best watches today offer more than prestige — they offer potential.he wrist might just be the new portfolio.

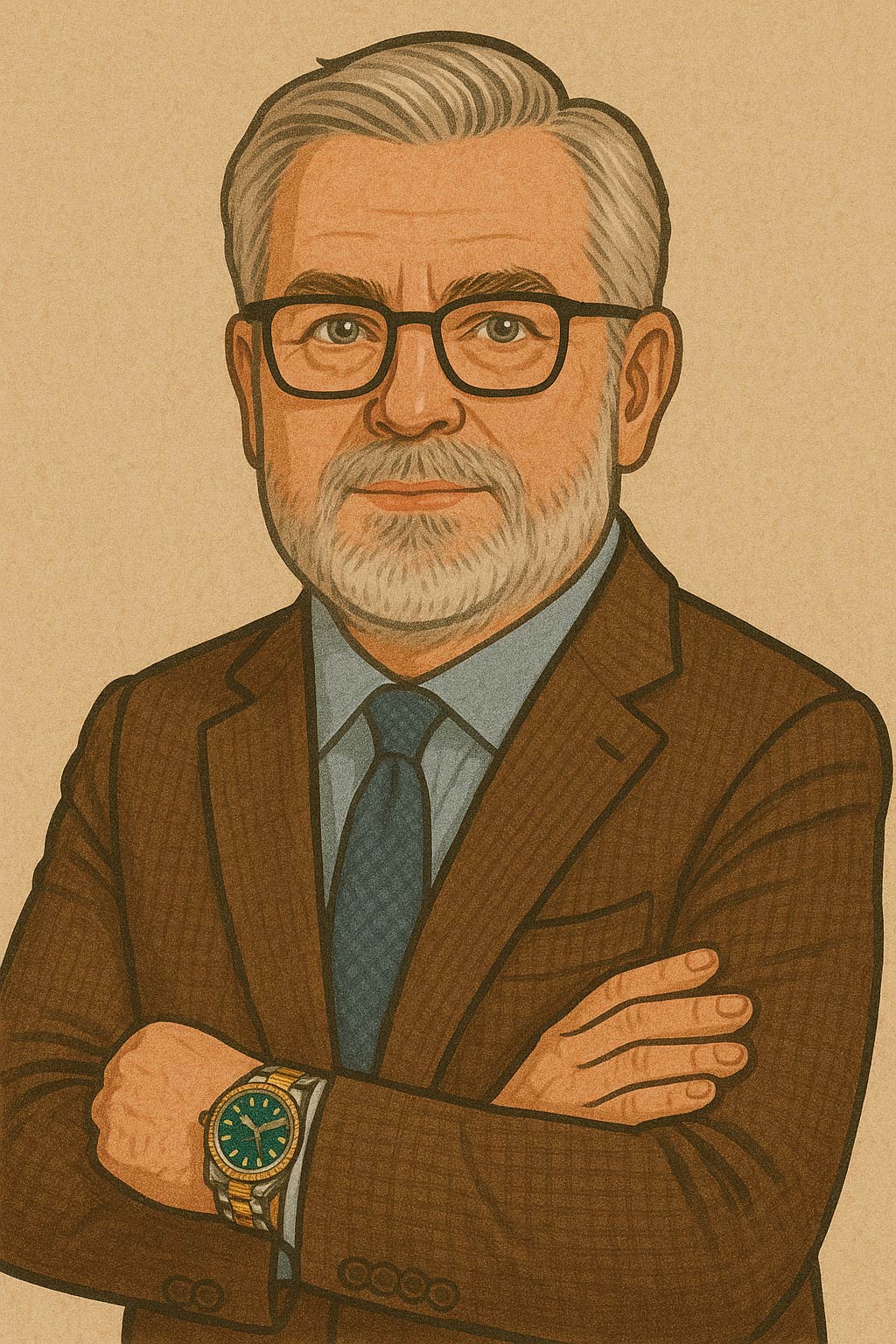

Lead Writer, Timepieces | YouImpressed.com

With decades of experience collecting and reviewing the world’s finest watches, Ryan brings sharp insight and a deep appreciation for craftsmanship to the world of horology. From legendary Swiss icons to obscure independent makers, his coverage blends expertise with genuine passion.

Born and raised in Switzerland, Ryan is the son of a watchmaker and a proud graduate of the University of Fribourg, where he earned his journalism degree. When he’s not writing about tourbillons and tachymeters, he’s birdwatching in the Swiss Alps with his wife—or selling homemade sausages and exotic mustard at the local farmers market in his hometown.

If you enjoy our content, consider supporting us. We are a growing site dedicated to bringing you the best in luxury and innovation. Your support helps us expand and keep delivering quality content. Every contribution makes a difference, and we truly appreciate it.

Donate

Note: This is a fictional bio. See About page for more information.